Research

|

(...) I have always been ridiculous, and

I have known it, perhaps, from the hour I was born.

Perhaps

from the time I was seven years old I knew I was

ridiculous.

Afterwards I went to school, studied at the

university, and, do

you know, the more I learned, the more thoroughly I

understood that I was ridiculous. So that it seemed in

the end

as though all the sciences I studied at the university

existed

only to prove and make evident to me as I went more

deeply

into them that I was ridiculous. (...)

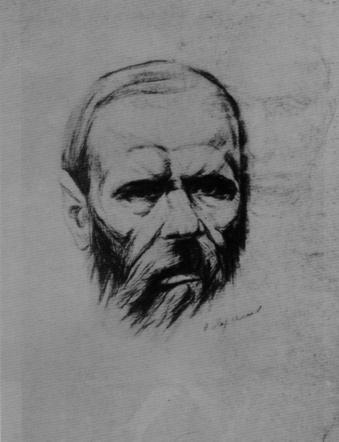

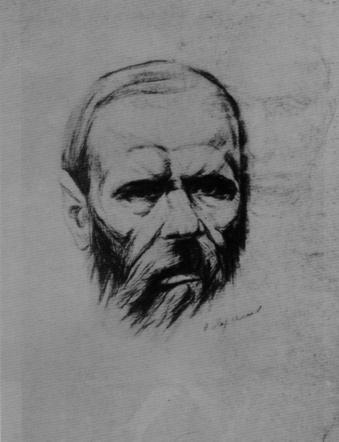

Fyodor Dostoevsky (1821-1881) in The

Dream

of a Ridiculous Man.

|

|

My current research activity is focused on Financial

Mathematics - the use of modern mathematical tools from

stochastic analysis, probability theory and statistics to

understand, model and make decisions in financial markets. As a

member of PhiMac

I worked in a number of research projects in this area, such as pricing

and hedging in incomplete markets (applications of

utility--based pricing to, among others, real options, stochastic

volatility and employee stock options), positive interest

rates (using the chaotic framework introduced by Hughston

and Rafailidis), systemic risk

and stability (using

network analysis and the tools from agent-based computational

economics) and more recently asset

price

bubbles (trying to use the techniques from dynamical

systems to formalize the ideas of Hyman Minsky, among others) and

climate-economic models (replacing the mainstream economic

part of Integrated Assessment Models with a more suitable

nonlinear, disequilibrium, economic model).

The subject of my PhD was Information

Geometry, and I still have an active interest in the

area. It is concerned with the furnishing of geometrical

structures to families of probability distributions, both

classical and quantum, either finite or infinite dimensional. A

look at the recent conference held in Leipzig

should

give

a

good

perspective

of the kind of problems and applications of the subject. I

personally arrived at information geometry because it can provide

a general way to develop dynamical models in nonequilibrium

statistical mechanics, but now I'm naturally more interested in

possible applications in mathematical finance.

Finally, back in my undergraduate times at the

University of Sao Paulo, I developed a strong interest for History

of Science, having written a couple of essays on

History of Mathematics and presented several talks in conferences

and meetings, both in Brazil and abroad. Although not working

professional on such matters any more, I am still a member of the

Sociedade Brasileira de Historia da Ciencia and try to

keep updated with the work of my historian friends, nurturing the

desire to do research in the field some day in the future.